Tips For Trading Forex Successfully

Undoubtedly, trading involves much more than just what is contained in some short tips. A solid trading system is necessary, augmented by experience, a courageous spirit, and, of course, capital.

But, for most people just starting in trading, and others who are possibly losing their zest and confidence due to large, but hopefully temporary, drops in market values, a basic overview can restore clarity to your trading.

With that goal in mind, some tips are presented that we hope will assist you as you seek to navigate these exciting financial waters.

1. If a position is showing negative activity, do not increase the risk by getting in deeper.

This is the same as the old trader’s saying, “Never add to a losing trade”.

2. Never fail to decide upon a stop and a profit objective prior to your entering a trade. Use your knowledge of the market to determine placement of stops, not the amount of money you have available in your account. It is not feasible to conduct the trade if an adequate stop is too costly.

3. Keep in mind the privilege of a position. A market judgment should not be made when you are already a position. Once you are in a position all of your decisions about adding to the position, protecting the position, or exiting the position should already be made.

4. Sometimes circumstances change and when you determine that, you make the choice to exit a trade. Don’t assume you can just take your choice of price with the easy plan to exit at the market. One example of this is when some surprise big news comes out following a big event. This can push the acceptable level of volatility beyond that which works with your trading methods.

5. Don’t buy a dull market in a Bear market and don’t sell a dull market in a Bull market.

Simply translated this means that if there is no momentum in one direction or the other then the chance of the follow through necessary to profit is slim. Enter trades that you have determined will have the greatest chance for success.

6. When the market is very volatile or is experiencing a lack of liquidity, you should not trade at all. Even when there is potential for extreme volatility caution should be exercised. Although volatile market movements hold the potential for huge gains they can be far too unpredictable. Always avoid unnecessary risk when trading.

7. It is important to keep in mind that the same trading systems do not always work in both up and down markets. If you have a trend-following Forex trading system you must understand that there is always the potential for it to perform less than admirably in sideways markets.

8. You need to adjust your trading strategy with each market type: up trending, range bound, and down trading. Ideally with a trend-following trading system it would be best to avoid sideways markets altogether. There is nothing wrong with a trend-following system which “stands aside” during sideways markets…in fact it is preferred that it stand aside.

9. Choose trades that move along with the dominant market pattern. Although up market and down market patterns are always discernable, one or the other is always the most dominant. For instance, during an up market, sell signals are repeatedly taken, only to be respectively stopped.

This all goes back to the timeless statement, “The trend is your friend”. Trading in the direction with the greatest probably for success is just common sense. This is not to say that you can’t develop a counter-trend trading system that can be profitable.

10. A sell signal is just a failed buy signal; a buy signal is just a failed sell signal.

11. A losing trade is always much less difficult to enter!

13. Follow your gut instincts; if you don’t feel good about something, don’t trade.

14. When you hear a Forex trading tip ignore it. Go with what you know and that is the trading system you have taken the time to develop faith in.

15. Current events in the news only are significant when they DO NOT propel the market in the direction of the news.

16. You gain a modicum of understanding when you read yesterday’s paper today, armed with knowledge of the market’s activity today. You realize that yesterday’s market activity has no impact on today’s.

17. Never make your trade decisions based on the direction of a gap. The market should not force you into a trade.

18. Use the rule of “in late, out early,” being mindful that the first tick and the last tick are by far the most expensive.

19. Exit when you realize everyone else is in.

20. Don’t add to the risk factor by trading when ill. Trading can be strenuous enough without the added stress of not feeling well. Avoid trading when there is anything which might affect your trading discipline.

21. Your unit of trading should only be altered when you have a plan of attained goals. You should establish a reduction plan for times when the market experiences lower volume or your trading is a little off.

A good money management system is part of every good trading plan. It will reduce your position size when your trading system gets out of sync with the market and increase your position size when your trading system is in sync with the market.

22. Don’t be cocky or boastful in any way. Enjoy your trading success with pride and modesty.

23. Judge your success by the growth of your equity over time and not by the success of individual trades. Even a bad trader can have a winning streak.

24. Taking a break from trading for a day will often break a losing streak.

25. If you are on a roll, keep going! You are doing something right. Why in the world would you want to stop? When you and your trading methods are in sync with the markets just keep your winning streak going.

26. When you are having an off day, turn off the computer screen and find something else to do. Don’t just keep at it when you are losing; that doesn’t make any sense.

Walking away for awhile is not an easy thing to do, but it is important to discipline yourself to do it.

27. Scalpers reduce the number of variables affecting market risk by being in trades or positions only for a few seconds. Day traders reduce market risk by being in trades for minutes.

It makes perfect sense that the smaller your profit target the quicker it will be hit. This is what has attracted so many to day trading. If this style of trading interests you please keep in mind the following:

Increased Frequency Of Trading = Increased Transactions Costs

28. The decision to convert a scalp or day trade into a position trade means that you did not understand the risks of the trade adequately.

29. Don’t let an opportunity that you missed trouble you. Opportunities are around every bend.

There are new opportunities every single day. So many new traders like to talk about the big money that they left on the table. Experienced traders are happy to have taken their slice of the price action. Rarely, if ever will you get 100% of the possible potential profit of ANY trade.

30. You are better served by learning to trade Forex than searching for an elusive secret formula.

31. Don’t trust the advice of others because they probably didn’t do as much research as you did.

This is a statement that really hits home. It does sometime seem that the grass is greener on the other side of the fence. There will be days when it seems like everyone else is in the know except you. Don’t let that bother you. If you’ve done your homework your time will come.

32. Mentally establish the reality of what is happening, good or bad, up or down, by affirming it aloud amid a mind full of preconceived notions.

If you have a losing trade don’t be afraid to say to yourself, “Cleary my trading method did not work out on that trade, but my research has shown me that if I continue on this path I will succeed!”

33. Flexibility is absolutely necessary to be a success at day trading. You need to be an informed participant, understanding the market potential for both sides of the market. An informed decision-maker makes trades with understanding of what is the current market climate.

34. Deliberate, even bemoan and confess your errors in discipline. You will continue to make these types of errors for many years, it seems, and so reminding yourself may delay the inevitable.

35. If this list made you uncomfortable, then you are like many other traders in two ways:

A. You have enough trading experience to understand that the mistakes are yours, not the market’s, and you seek to overcome these inadequacies.

B. Oddly enough, you have become one with the market. You could not leave, and you do not want to. Wherever you go in life, you will ALWAYS keep tabs on the market.

Additional Market Wisdom To Help You Trade Successfully

1. Trade in the direction of the trend with small accounts under $25,000. Forex trading permits bi-directional trading which appeals to beginners, but your odds are better trading in the direction of the trend in the long term.

2. Keep two accounts: one is a real one and one is a demo. Use the demo account to test alternative trades, continuing with lifelong learning, although an active trader.

3. Stop trying to predict the future; you can’t. There are no leading indicators. There is software on the market to predict market trends, but if you think about it, if it worked, would they tell you about it?

This is extremely important to understand. By the time you search out and think you have found the Holy grail of Forex trading you could have amassed a fortune in profits.

4. Use the daily charts to help you time your trades: the four-hour chars and one hour charts. Trading at 15 and 30 minute increments takes quite a lot of skill.

5. Be an observer of patterns. Trade the pattern instead of the time frame. You will see hesitation, reversal and breakout patterns quite often.

6. The more lots you trade, the safer, if you can afford it. Trading consists of technical analysis, money management and a lot of emotional energy. It is difficult to make the best entry and exit decisions with just one lot alone. This is because you don’t have the flexibility to take partial profits or add to your position.

7. Trading at the extremes seems to up the odds that you are going in the right direction. Extreme trading is actually conservative trading!

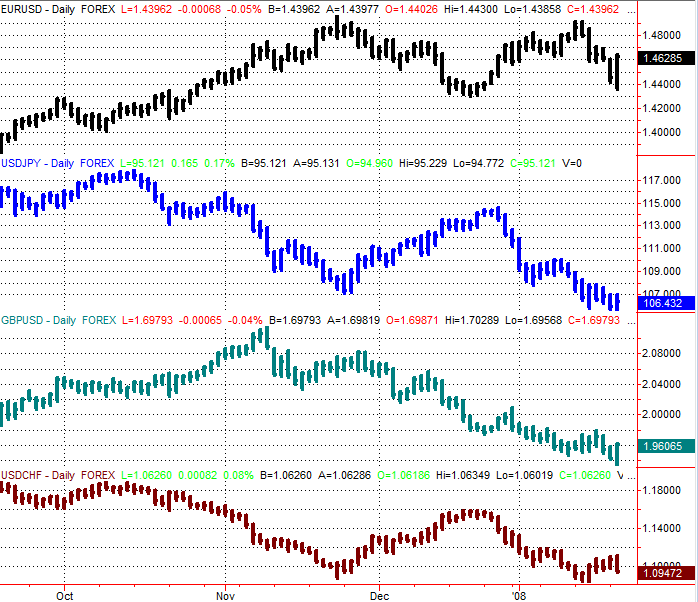

8. Carefully review the major currency pair before taking a position in any of them. You may have missed something.

They are:

USDJPY – US dollar/Yen

EURUSD – Euro/US dollar

USDCHF – US dollar/Swiss

GBPUSD – Pound/US dollar

(see chart of these below)

Figure1.0 Major Currency Pairs – Daily Data

9. There is something called the “Upside Down rule.” It sounds silly, but works. If you can turn a chart upside down and it does not look any different to you, then stay away from it.